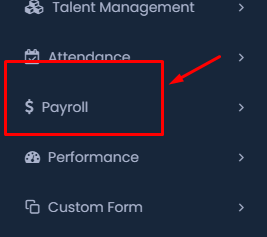

1. Accessing the Payroll Section

- On the sidebar, locate the Payroll section, as indicated by the dollar sign icon (💵). Click on it to expand the payroll options.

- This section is crucial for managing all aspects related to employee payroll, including salary disbursements, loan applications, and salary history.

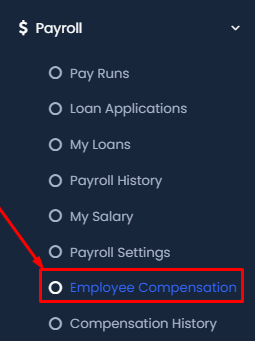

2. Navigating to Employee Compensation

- After expanding the Payroll section, you’ll see various options related to payroll management.

- Click on Employee Compensation. This option allows you to manage and view the compensation details of employees, including their monthly salaries and any additional compensations or deductions.

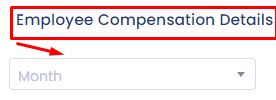

3. Filtering Compensation Details

- In the Employee Compensation Details section, you can filter the data by selecting specific criteria.

- Month: Use this dropdown to select the desired month for which you want to view or manage compensation.

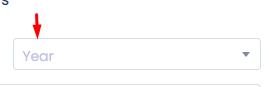

- Year: Choose the year corresponding to the compensation data you wish to access.

- Salary Frequency: You can filter by the frequency of salary payments (e.g., monthly, bi-weekly) to narrow down your results.

- Quarter: Select the quarter (e.g., Q1, Q2) if you are interested in reviewing quarterly compensation details.

- Department: Choose the department to filter employees’ compensation by their respective departments.

- Employee: Finally, select the specific employee whose compensation details you wish to view or edit.

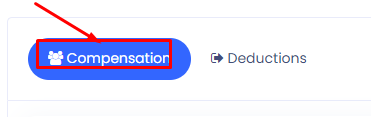

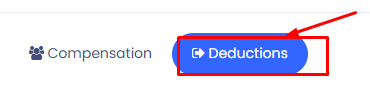

4. Switching Between Compensation and Deductions

- At the bottom of the Employee Compensation Details section, you will find two buttons:

- Compensation: Clicking this button will display the compensation details.

- Deductions: If you need to view or manage any deductions from an employee’s salary, switch to this tab.

- These buttons allow you to toggle between viewing the compensation figures and any deductions that apply, providing a comprehensive view of the employee’s salary structure.

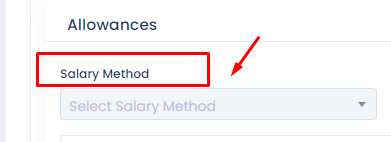

5. Configuring Allowances and Salary Details

- In the Employee Compensation Details section, navigate to the Allowances area.

- Salary Method: Select the method by which the employee’s salary will be processed (e.g., direct deposit, check). Use the dropdown menu under the Salary Method label to make your selection.

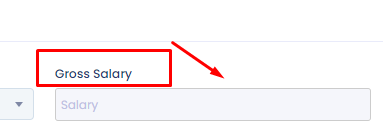

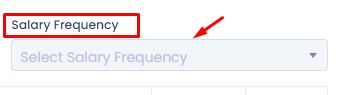

6. Entering Salary Information

- Gross Salary: This field is where you input the total salary amount before any deductions or taxes are applied. This is a critical figure as it impacts various compensation calculations.

- Enter the employee’s gross salary in the provided field under the Gross Salary label.

- Salary Frequency: Choose how often the employee receives their salary. Options may include monthly, bi-weekly, or weekly payments.

- This selection ensures that the salary is distributed according to the employee’s contract and organizational policies.

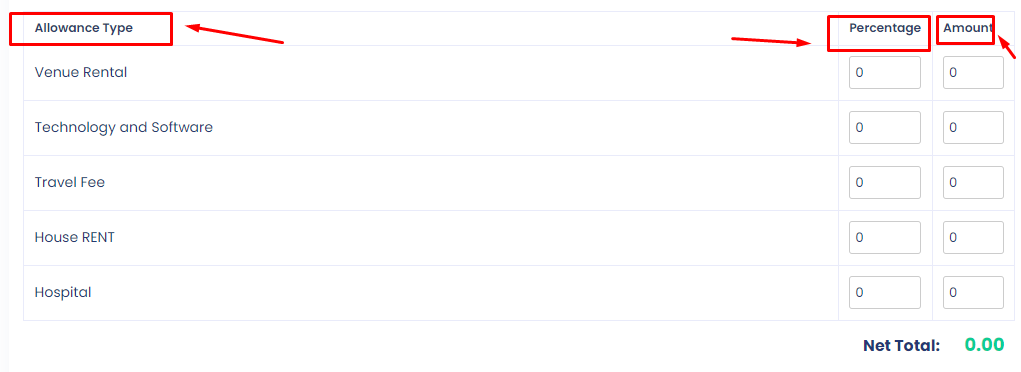

7. Configuring Allowances

- Percentage and Amount: For each allowance type (e.g., Venue Rental, Technology and Software, Travel Fee, House Rent, Hospital), you can input either a percentage of the salary or a specific amount.

- The system will automatically calculate the Net Total of all allowances, which will be added to the employee’s gross salary.

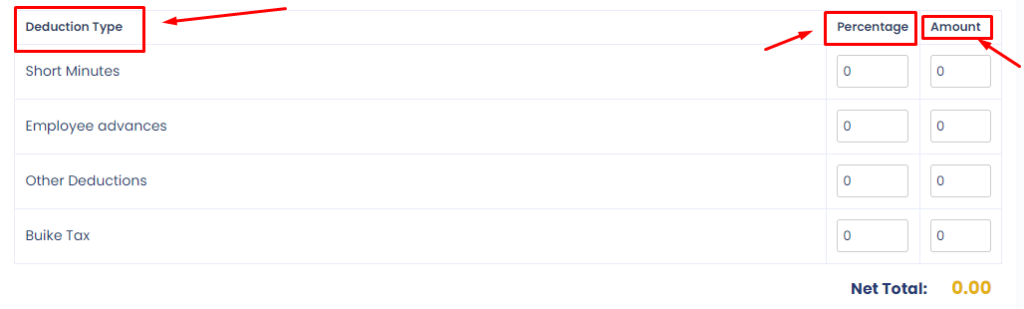

8. Managing Deductions

- Switch to the Deductions tab to enter any deductions that apply to the employee’s salary. Common deduction types might include Short minutes (for time not worked), Employee Advances, Other Deductions, and Buike Tax.

- As with allowances, you can input deductions as either a Percentage of the gross salary or a specific Amount.

- The system will then calculate the Net Total of all deductions, which will be subtracted from the employee’s gross salary to determine the final payable amount.

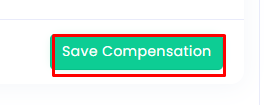

9. Finalizing and Saving Compensation and Deductions

- Click the Save Compensation button to save the compensation details.

- If you have entered deductions, click the Save Deduction button to ensure these are recorded as well.

- These actions will finalize the compensation and deduction details, ensuring accurate payroll processing.

This extended guide covers all the necessary steps for managing employee compensation, from setting up salary methods to saving deductions. By following these instructions, you ensure that your payroll system accurately reflects each employee’s compensation structure. For further customization or support, consult your HR system’s help resources or contact your HR administrator.